Syfe - Sit Down with Silverdale CIO

Syfe - Sit Down with Silverdale CIO

Syfe - Sit Down with Silverdale CIO

Syfe - Sit Down with Silverdale CIO

Syfe - Sit Down with Silverdale CIO

Nov 3, 2025

Syfe’s “𝗦𝗶𝘁 𝗗𝗼𝘄𝗻 𝘄𝗶𝘁𝗵 𝗦𝗶𝗹𝘃𝗲𝗿𝗱𝗮𝗹𝗲 𝗖𝗜𝗢” showcased why Fixed Income is back in the spotlight, and the opportunities are bigger than ever!

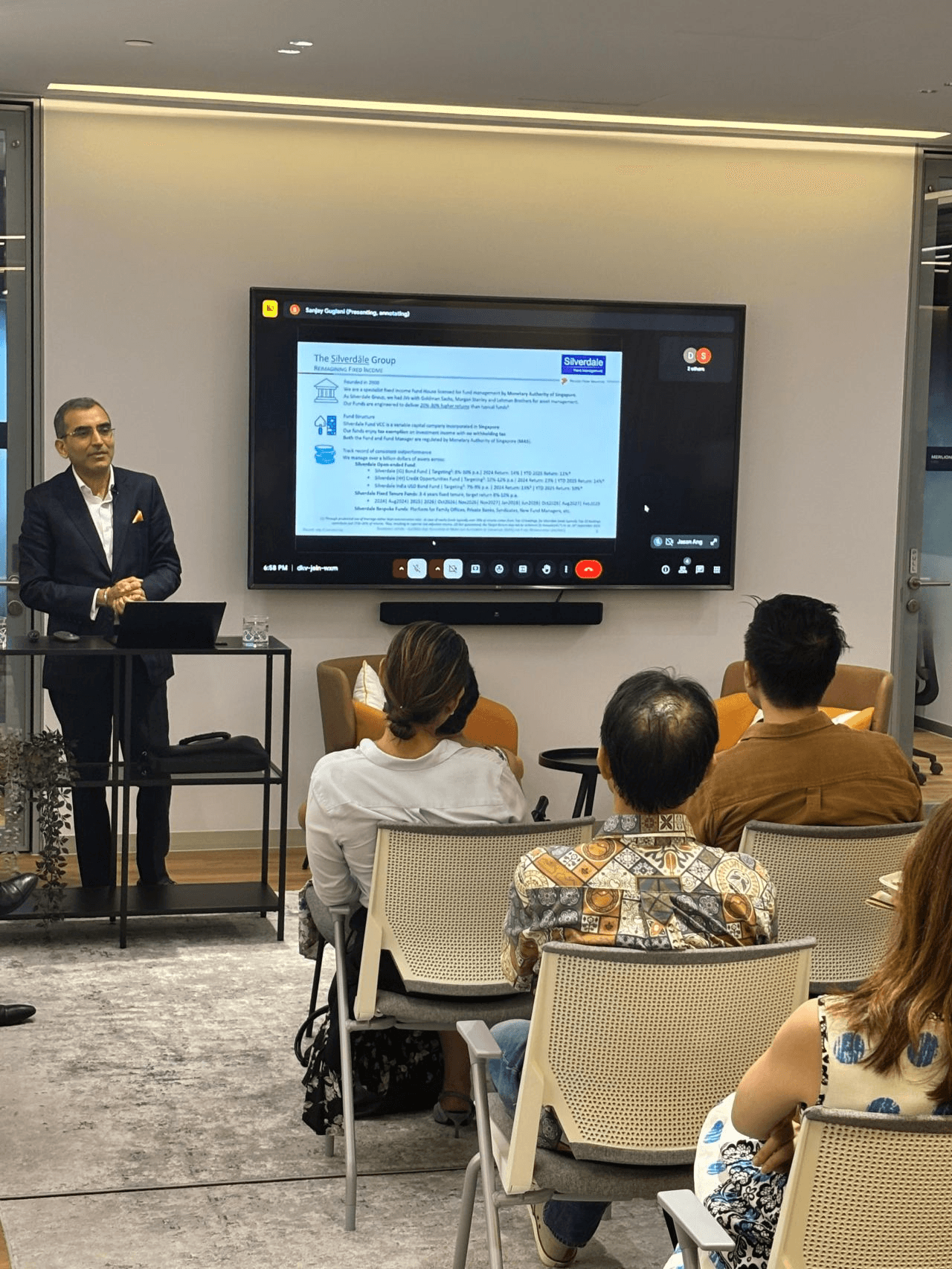

Earlier this month, Silverdale Founder & CIO Sanjay Guglani shared our house views on the 𝗙𝗶𝘅𝗲𝗱 𝗜𝗻𝗰𝗼𝗺𝗲 𝗢𝘂𝘁𝗹𝗼𝗼𝗸 and the massive opportunities emerging in today’s macroeconomic environment.

The evening featured an engaging deep dive with Ritesh Ganeriwal, Managing Director & Head of Investment & Advisory at Syfe, followed by a highly interactive Q&A with a savvy audience. Together, we uncovered numerous hidden gems in fixed income and explored how disciplined strategies can deliver equity-like returns with less than half the risk.

A big thank you to everyone who joined us and to the Syfe team for an evening of stimulating ideas and meaningful conversations.

For any inquiries, please reach out to us at [email protected].

Keep up to date with Silverdale Funds by following our Linkedin

Connecting the Dots.

Sign up to receive insights and analysis from Silverdale Funds

© 2025 Silverdale Capital Pte Ltd. All rights reserved. *Source: Silverdale Capital, as of 31 May 2025.

This material is distributed in Singapore by Silverdale Capital Pte Ltd (Company Registration No. 200820921K), which is licensed and regulated by the Monetary Authority of Singapore (MAS) under a Capital Markets Services Licence. This publication or website content has not been reviewed by the MAS.

All investments carry risk. Historical performance is not necessarily indicative of future returns. Forward-looking statements or projections are not guarantees and may not be realised. Any reliance on the information presented is at the discretion of the reader. Overseas investments may entail additional risks such as currency fluctuations, reduced market liquidity, weaker regulatory protections, and heightened political or economic instability. Fixed income securities may be affected by interest rate movements and credit events. As interest rates rise, bond prices typically decline. Credit risk arises if issuers are unable to meet interest or principal repayments.

This material is provided for general informational purposes only and does not constitute investment advice, research, an offer, or a solicitation to transact in any financial product. It does not take into account the specific investment objectives, financial situation, or particular needs of any individual. While the content is based on information believed to be reliable, Silverdale Capital makes no representations or warranties as to its completeness or accuracy. Any index references are for illustrative purposes only; direct investment in an index is not possible. Mentions of specific companies are for example purposes only and do not constitute a recommendation or opinion on their investment merits.

© 2025 Silverdale Capital Pte Ltd. All rights reserved.

Connecting the Dots.

Sign up to receive insights and analysis from Silverdale Funds

© 2025 Silverdale Capital Pte Ltd. All rights reserved. *Source: Silverdale Capital, as of 31 May 2025.

This material is distributed in Singapore by Silverdale Capital Pte Ltd (Company Registration No. 200820921K), which is licensed and regulated by the Monetary Authority of Singapore (MAS) under a Capital Markets Services Licence. This publication or website content has not been reviewed by the MAS.

All investments carry risk. Historical performance is not necessarily indicative of future returns. Forward-looking statements or projections are not guarantees and may not be realised. Any reliance on the information presented is at the discretion of the reader. Overseas investments may entail additional risks such as currency fluctuations, reduced market liquidity, weaker regulatory protections, and heightened political or economic instability. Fixed income securities may be affected by interest rate movements and credit events. As interest rates rise, bond prices typically decline. Credit risk arises if issuers are unable to meet interest or principal repayments.

This material is provided for general informational purposes only and does not constitute investment advice, research, an offer, or a solicitation to transact in any financial product. It does not take into account the specific investment objectives, financial situation, or particular needs of any individual. While the content is based on information believed to be reliable, Silverdale Capital makes no representations or warranties as to its completeness or accuracy. Any index references are for illustrative purposes only; direct investment in an index is not possible. Mentions of specific companies are for example purposes only and do not constitute a recommendation or opinion on their investment merits.

© 2025 Silverdale Capital Pte Ltd. All rights reserved.

Connecting the Dots.

Sign up to receive insights and analysis from Silverdale Funds

© 2025 Silverdale Capital Pte Ltd. All rights reserved. *Source: Silverdale Capital, as of 31 May 2025.

This material is distributed in Singapore by Silverdale Capital Pte Ltd (Company Registration No. 200820921K), which is licensed and regulated by the Monetary Authority of Singapore (MAS) under a Capital Markets Services Licence. This publication or website content has not been reviewed by the MAS.

All investments carry risk. Historical performance is not necessarily indicative of future returns. Forward-looking statements or projections are not guarantees and may not be realised. Any reliance on the information presented is at the discretion of the reader. Overseas investments may entail additional risks such as currency fluctuations, reduced market liquidity, weaker regulatory protections, and heightened political or economic instability. Fixed income securities may be affected by interest rate movements and credit events. As interest rates rise, bond prices typically decline. Credit risk arises if issuers are unable to meet interest or principal repayments.

This material is provided for general informational purposes only and does not constitute investment advice, research, an offer, or a solicitation to transact in any financial product. It does not take into account the specific investment objectives, financial situation, or particular needs of any individual. While the content is based on information believed to be reliable, Silverdale Capital makes no representations or warranties as to its completeness or accuracy. Any index references are for illustrative purposes only; direct investment in an index is not possible. Mentions of specific companies are for example purposes only and do not constitute a recommendation or opinion on their investment merits.

© 2025 Silverdale Capital Pte Ltd. All rights reserved.

Connecting the Dots.

Sign up to receive insights and analysis from Silverdale Funds

© 2025 Silverdale Capital Pte Ltd. All rights reserved. *Source: Silverdale Capital, as of 31 May 2025.

This material is distributed in Singapore by Silverdale Capital Pte Ltd (Company Registration No. 200820921K), which is licensed and regulated by the Monetary Authority of Singapore (MAS) under a Capital Markets Services Licence. This publication or website content has not been reviewed by the MAS.

All investments carry risk. Historical performance is not necessarily indicative of future returns. Forward-looking statements or projections are not guarantees and may not be realised. Any reliance on the information presented is at the discretion of the reader. Overseas investments may entail additional risks such as currency fluctuations, reduced market liquidity, weaker regulatory protections, and heightened political or economic instability. Fixed income securities may be affected by interest rate movements and credit events. As interest rates rise, bond prices typically decline. Credit risk arises if issuers are unable to meet interest or principal repayments.

This material is provided for general informational purposes only and does not constitute investment advice, research, an offer, or a solicitation to transact in any financial product. It does not take into account the specific investment objectives, financial situation, or particular needs of any individual. While the content is based on information believed to be reliable, Silverdale Capital makes no representations or warranties as to its completeness or accuracy. Any index references are for illustrative purposes only; direct investment in an index is not possible. Mentions of specific companies are for example purposes only and do not constitute a recommendation or opinion on their investment merits.

© 2025 Silverdale Capital Pte Ltd. All rights reserved.

Connecting the Dots.

Sign up to receive insights and analysis from Silverdale Funds

© 2025 Silverdale Capital Pte Ltd. All rights reserved. *Source: Silverdale Capital, as of 31 May 2025.

This material is distributed in Singapore by Silverdale Capital Pte Ltd (Company Registration No. 200820921K), which is licensed and regulated by the Monetary Authority of Singapore (MAS) under a Capital Markets Services Licence. This publication or website content has not been reviewed by the MAS.

All investments carry risk. Historical performance is not necessarily indicative of future returns. Forward-looking statements or projections are not guarantees and may not be realised. Any reliance on the information presented is at the discretion of the reader. Overseas investments may entail additional risks such as currency fluctuations, reduced market liquidity, weaker regulatory protections, and heightened political or economic instability. Fixed income securities may be affected by interest rate movements and credit events. As interest rates rise, bond prices typically decline. Credit risk arises if issuers are unable to meet interest or principal repayments.

This material is provided for general informational purposes only and does not constitute investment advice, research, an offer, or a solicitation to transact in any financial product. It does not take into account the specific investment objectives, financial situation, or particular needs of any individual. While the content is based on information believed to be reliable, Silverdale Capital makes no representations or warranties as to its completeness or accuracy. Any index references are for illustrative purposes only; direct investment in an index is not possible. Mentions of specific companies are for example purposes only and do not constitute a recommendation or opinion on their investment merits.

© 2025 Silverdale Capital Pte Ltd. All rights reserved.