In the hyper-connected world, news and reactions travel faster than reasoning and fundamentals. It took less than 72 hours for Silicon Valley Bank (SVB) with US$ 211 billion of assets to collapse. It took less than 48 hours for Signature Bank with US$ 110 billion of assets to crumble. It took less than 16 hours for 167-years old Credit Suisse Bank (CS) with over US$ 1.5 trillion of assets to fall down. UBS took over Credit Suisse practically for free, wiping out US$ 35 billions of equity and US$ 15 billions of AT-1 bonds AND it took less than 8 hours to recoup over US$ 25 billions of CS bonds MTM loss.

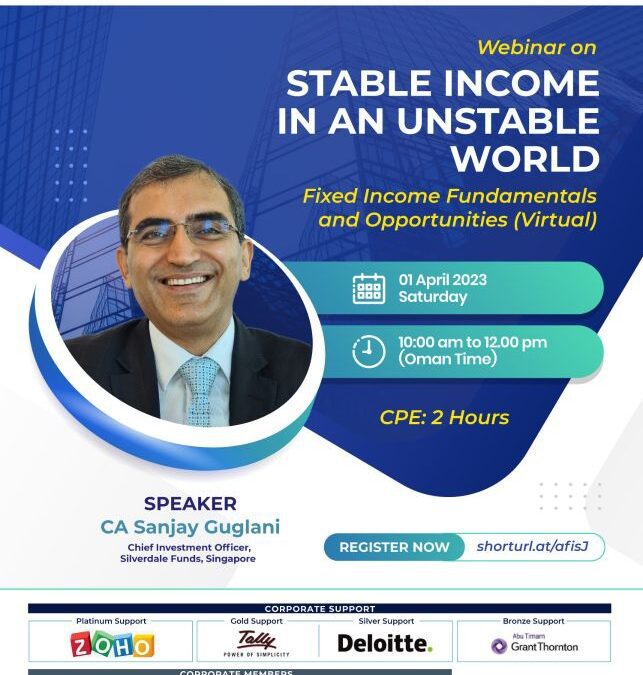

This proved once again: volatility is the friend of an investor, an enemy of a speculator, and that fortune favors the prepared.To explain how to “lock-in” the prevalent higher interest rates while navigating treacherous volatility of the markets, CA Sanjay Guglani, Chief Investment Officer of Silverdale Funds, Singapore, will share take-aways from SVB and CS, walk through the fundamentals of fixed income investing, explain how to optimize risk-adjusted returns, and explore various investment opportunities.The seminar provides CPE Credit of 2 hours.

See you there!

This webinar is free for Silverdale stakeholders, please register at:Registration Link: https://tinyurl.com/SilverdaleMCICAI Event DetailsDate: 01 April Saturday Time: 10:00am – 12:00pm (Oman Time)CPE Credits: 2 hours

For any further information, please contact Investor Relations, Silverdale Capital Pte Ltd at [email protected].